Topic: Business Insights

Small Businesses Face Fraud Attempts Every Day: Here's How to Stay Safe

Our team at Lincoln Savings Bank would like to share some key strategies to help you safeguard your business and the amazing people you've built your team around. With these steps in mind, along with the awareness of potential fraud, you'll discover how to protect your livelihood and those who rely on you.

Types of Capital and How to Generate Them. | Lincoln Savings Bank, Business Lending

Your business needs more capital in order to grow, a business loan can help you do that. There are many different types of capital, so learn about how you can get more of each for your business.

Iowa SBA Loan Application: What You Need to Know - Lincoln Savings Bank | LSB Financial | Banking, Insurance, Investments, Trust and Mortgage Services for Iowa

Iowa SBA Loan Application: What You Need to Know posted 2/6/2017 in Business ? Tips to Avoid an SBA Loan Rejection When applying for a loan guaranteed by t

Resources for Iowa Businesses | Lincoln Savings Bank Blog

To support you, Lincoln Savings Bank is staying up to date on resources available to Iowa businesses through the U.S. Small Business Administration (SBA) and the State of Iowa.

Should You Refinance Your Business Debt with an SBA 7a Loan? | Lincoln Savings Bank

Restructuring debt with a 7(a) loan from the Small Business Administration (SBA) can be a strategic financial move that many businesses haven't considered. Contact the experienced lenders at Lincoln Savings Bank to learn more.

Concrete Coatings Company Starts Strong During Pandemic With SBA Loan | Lincoln Savings Bank

With help from an SBA 7(a) loan and the small business lending team at LSB, Revival Concrete Coatings was born. Read more about how Lincoln Savings Bank helped bring this business to life.

Questions to Ask Before You Update Equipment on the Farm

Ask yourself these questions before you decide to lease or buy new farm equipment.

How to Offer a Benefits Package As a Small Business - Lincoln Savings Bank | LSB Financial | Banking, Insurance, Investments, Trust and Mortgage Services for Iowa

How to Offer a Benefits Package As a Small Business posted 1/3/2021 in Insurance Recruiting and retaining employees can be challenging for a small business

The Importance of Your Personal Credit Score If You Want an SBA Loan | Lincoln Savings Bank

When it comes to qualifying for an SBA loan, a borrower's personal credit score is an important consideration when making approval decisions. Learn more about how your personal credit score affects you as a business owner.

Hotel Grinnell | Community Passion Meets Big Ideas

One of small towns most valuable assets is its unfilled buildings. Why not breathe new life into these building and use them to fill emerging needs? Hotel Grinnell's team includes Lincoln Savings Bank, who helped them with their extensive experience and knowledge on the financial side of starting a business.

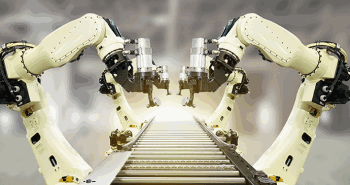

Benefits of Leasing Manufacturing Equipment

If your manufacturing business needs to keep up with advancements in the marketplace, or you want to maintain more liquidity over time, leasing might be for you.